You trusted someone to help your parent, spouse, or loved one manage daily life. Maybe they needed support with banking, bills, or medical decisions. Now something feels off. Money is missing. Stories do not line up. The person who once handled finances carefully seems anxious or confused.

That uneasy feeling is often the first warning sign of elder financial exploitation. It is one of the most common and least reported forms of elder abuse in Arizona, and it often happens quietly, behind closed doors, by people the family knows.

Understanding the red flags matters. Early recognition can stop ongoing harm and protect what your loved one worked a lifetime to build.

What Is Elder Financial Exploitation?

Elder financial exploitation happens when someone improperly uses an older adult’s money, property, or assets for personal benefit. It can involve outright theft, coercion, deception, or misuse of authority like a power of attorney.

In Arizona, financial exploitation is taken seriously under elder abuse laws because it often occurs alongside neglect, emotional abuse, or cognitive decline. Victims may feel embarrassed, fearful, or dependent on the very person exploiting them.

That combination makes this form of abuse especially difficult to detect.

Why Financial Exploitation Often Goes Unnoticed

Financial abuse rarely leaves visible bruises. Instead, it leaves paper trails, emotional shifts, and unexplained decisions.

Common reasons it goes unnoticed include:

- The abuser is a trusted family member or caregiver

- The elder fears retaliation or abandonment

- Cognitive decline makes details hard to explain

- Families live out of state or visit infrequently

By the time clear proof emerges, significant damage may already be done.

Behavioral Red Flags to Watch For

Changes in behavior are often the earliest warning signs. Pay close attention if your loved one begins acting differently around money or decision-making.

1. Sudden Fear or Anxiety About Finances

An elder who was once confident may suddenly seem nervous discussing money. They may avoid conversations about bills, banking, or expenses. This can signal coercion or fear of upsetting someone who controls access to their finances.

2. Withdrawal From Family or Friends

Isolation is a common tactic used by financial abusers. If a loved one stops returning calls, cancels visits, or seems discouraged from seeing family, that isolation may be intentional. Isolation makes manipulation easier and reduces the chance someone will notice irregularities.

3. Uncharacteristic Secrecy

Watch for statements like:

- “I’m not allowed to talk about that anymore.”

- “They said I shouldn’t bother you with this.”

- “I signed something but don’t really understand it.”

Secrecy around finances is rarely healthy, especially when it is new or enforced by someone else.

Financial Red Flags in Bank Accounts and Assets

Paperwork often tells the story long before a victim does.

1. Unexplained Withdrawals or Transfers

Large cash withdrawals, frequent ATM use, or transfers to unfamiliar accounts are major red flags. These transactions are especially concerning if the elder does not leave home often or cannot explain them.

2. Missing Funds or Valuables

Jewelry, heirlooms, or cash disappearing without explanation should never be dismissed as forgetfulness without further review. Patterns matter. One missing item may be accidental. Repeated losses are not.

3. Sudden Changes to Wills or Beneficiaries

Be alert if your loved one changes a will, trust, or beneficiary designation unexpectedly, particularly when long-standing family members are removed or the elder seems confused about the change. These decisions are often made under pressure or manipulation.

4. New Joint Accounts or Added Names

Adding someone to a bank account or property title gives them legal access to funds. Abusers often push for this under the guise of “helping” with errands or bills. Once added, funds can be drained quickly and legally, even if the elder never intended that outcome.

Caregiver and Power of Attorney Red Flags

Financial exploitation frequently involves someone in a position of authority.

1. Misuse of Power of Attorney

A power of attorney is meant to protect, not enrich, the agent. Red flags include using funds for personal purchases, refusing to share records, or making transfers that benefit themselves. In Arizona, misuse of a power of attorney can carry serious civil and criminal consequences.

2. Caregivers Living Beyond Their Means

If a caregiver suddenly has new vehicles, vacations, or luxury items without a clear explanation, it is reasonable to question where that money came from.

3. Resistance to Oversight

Honest caregivers welcome transparency. Abusers resist it. Be cautious if someone blocks access to mail, refuses financial reviews, or becomes defensive when questioned.

Digital and Scam-Related Red Flags

Financial exploitation increasingly happens through technology.

1. Phone, Email, or Online Scams

Older adults are frequently targeted by fake government calls, tech support scams, romance scams, and investment schemes. Urgent payment demands, threats of arrest, or requests for secrecy are major warning signs.

2. Repeated Payments to Unknown Sources

Look for patterns such as repeated gift card purchases, wire transfers overseas, or vague charges labeled as fees or penalties. These are common markers of scam activity.

Arizona-Specific Protections and Reporting

Arizona law recognizes financial exploitation as a form of elder abuse and provides specific reporting pathways.

The Arizona Department of Health Services oversees licensed care facilities and works alongside Adult Protective Services to investigate abuse and neglect. Financial exploitation can occur in private homes, assisted living, memory care, or nursing facilities.

Early reporting can freeze accounts, stop transfers, and preserve evidence before further harm occurs.

The Emotional Impact on Families

Discovering financial exploitation is devastating. Families often feel guilt for not seeing the signs sooner, anger toward the abuser, and fear about what has already been lost.

When the abuser is a family member, emotions become even more complicated. Legal guidance can help families protect their loved one while reducing conflict and confusion.

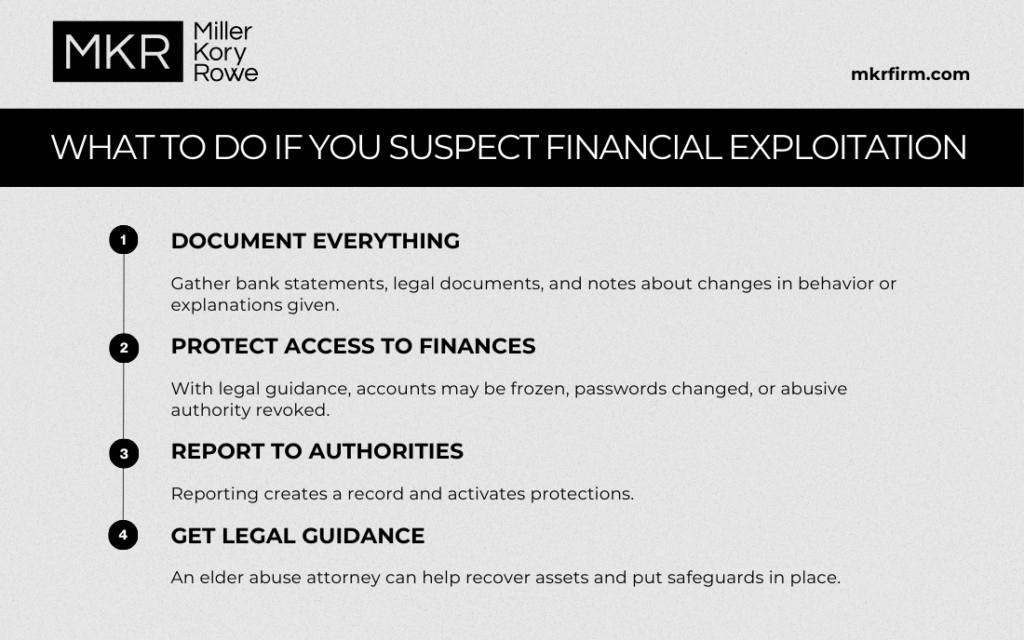

What to Do If You Suspect Financial Exploitation

Acting quickly can limit damage and protect your loved one.

FAQs About Elder Financial Exploitation

Q: How common is elder financial exploitation?

It is one of the most common forms of elder abuse and one of the least reported.

Q: Can financial exploitation happen without physical abuse?

Yes. Many victims experience financial harm without any visible signs of neglect or injury.

Q: What if my loved one says everything is fine?

Fear, dependence, or confusion often prevent honest disclosure. Patterns and documentation matter.

Q: Is financial exploitation a crime in Arizona?

Yes. It may result in civil liability, criminal charges, or both.

Q: Can stolen money be recovered?

In many cases, yes, especially when action is taken early.

Q: What if the abuser is a family member?

Family involvement does not excuse exploitation. Legal options still exist.

Q: Who investigates elder financial abuse in Arizona?

Adult Protective Services, law enforcement, and regulatory agencies depending on the setting.

Bottom Line

Elder financial exploitation thrives in silence and misplaced trust. The warning signs are often subtle at first, but they become clearer over time.

If something feels wrong, trust that instinct. Taking action is not disloyal, it is protective. Your loved one deserves dignity, safety, and financial security.

Need help navigating a difficult situation? The attorneys at Miller Kory Rowe offer skilled, compassionate support right here in Arizona. Reach out today.